huntsville al sales tax registration

This is a NEW process for Madison County - the. The minimum combined 2022 sales tax rate for Huntsville Alabama is.

Registration is required prior to the online sale.

. Sales Tax is imposed on the retail sale of tangible personal property in Huntsville. E huntsville al 35801. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact.

Sales tax is collected by the seller from their customer. The sales tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales. Annual Ad Valorem Tax.

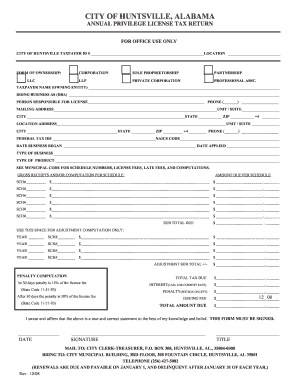

Business License Annual Tax Return. Tobacco tax is imposed on the sale or distribution of tobacco products within Huntsville city limits Wholesale Wine Tax Rate A wine tax is levied by the State to be paid directly to the City. 1918 North Memorial Parkway Huntsville AL 35801 256 532-3498 256 532-3760.

Find out with a business license compliance package or upgrade for professional help. Registration begins a few weeks prior to sale on Friday May 6 2022. 1002 remainder sales tax m ax discount 400 5 nettax due item 1 - item4.

Do you need to submit a Tax Registration in Huntsville AL. 100 northside squar. 100 North Side Square Huntsville AL 35801 Physical Address.

In Alabama the fees for registering new cars and renewing existing ones are much simpler with a yearly registration fee of 23 and a 15 year title fee of 13. Businesses should complete a simple tax account registration form with the City to receive an account number for reporting purposes. Sales reps or employees soliciting business in Huntsville.

Once you register online it takes 3-5 days to receive an account number. Reporting period fromto taxpayer name address. Business Tax Online Registration System.

Learn more and apply for a tax account number for. If delinquentitem 1 item2 total amount due account no. Mail completed application to.

Madison county sales tax department madison county courthouse. Businesses must use My Alabama Taxes MAT to apply online for a tax account number for the following tax types. 8 rows Sales Tax.

If you have any questions please call the. Huntsville collects and administers the following. This is the total of state county and city sales tax rates.

For use if any of the following apply. However pursuant to Section 40-23-7 Code of. Access detailed information on sales tax holidays in Alabama.

What is the sales tax rate in Huntsville Alabama.

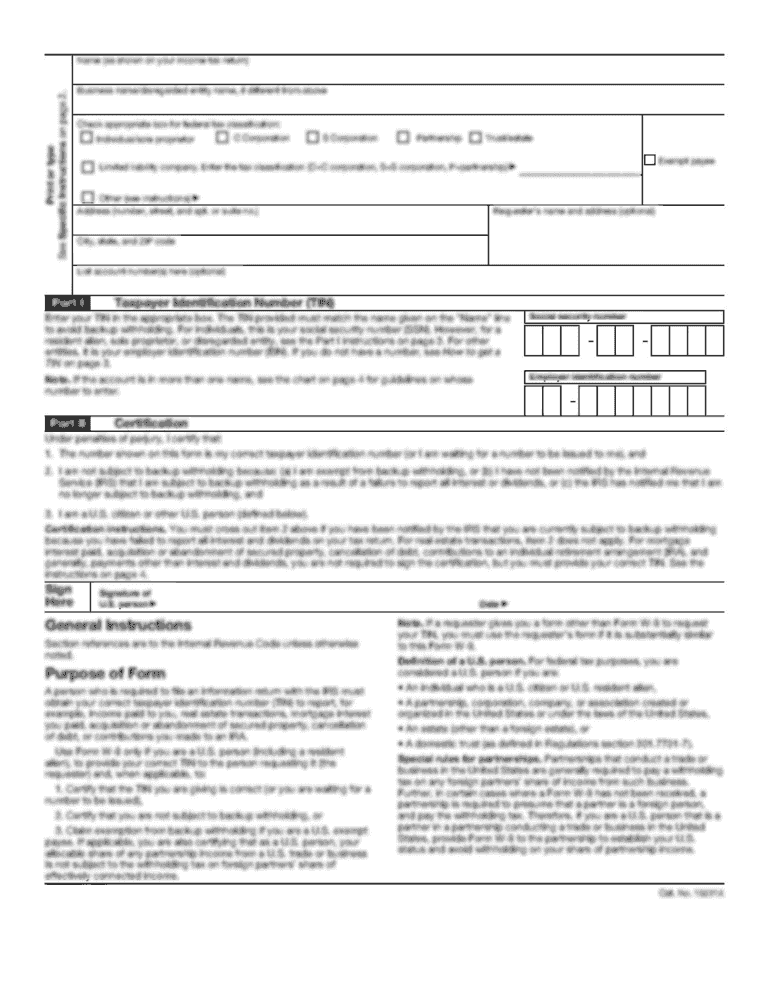

Huntsville Al Business License Fill Online Printable Fillable Blank Pdffiller

Map Of Madison County Madison County Al

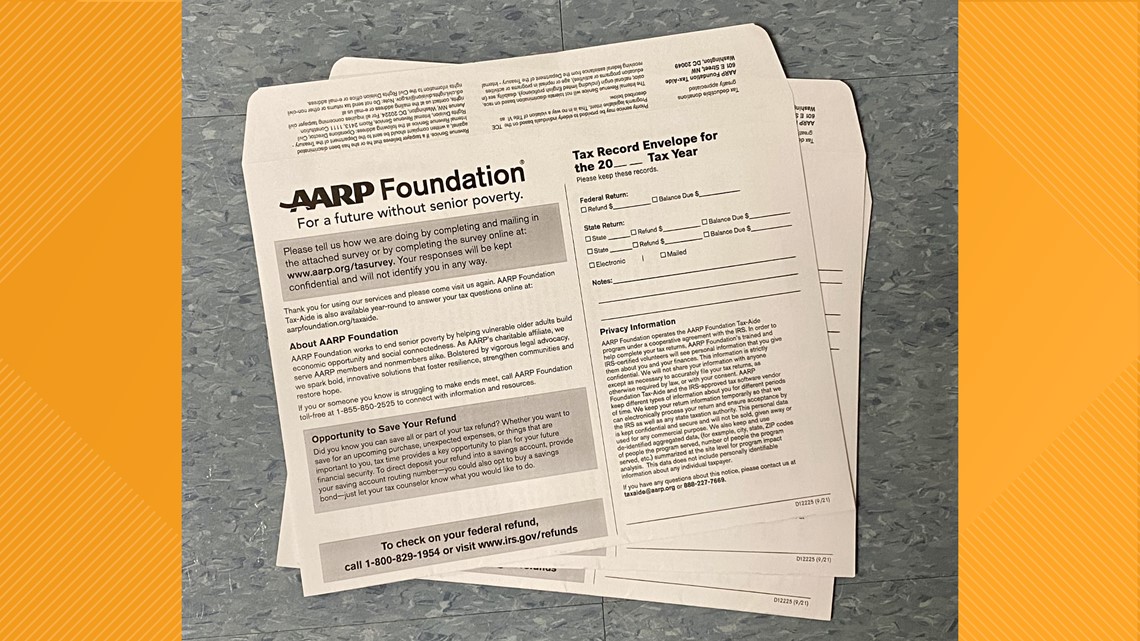

Tax Filing Help For Seniors Rocketcitynow Com

Huntsville Al Business License Fill Online Printable Fillable Blank Pdffiller

Accounting Business Services Of Huntsville Better Business Bureau Profile

Huntsville Al Business License Fill Online Printable Fillable Blank Pdffiller

Tax Filing Help For Seniors Rocketcitynow Com

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price

West Oaks Apartments Fill Online Printable Fillable Blank Pdffiller

Madison County Residents Will Soon Have Faster Access To Car Tags Driver S License Renewals Al Com

Huntsville Officer Promotes T Shirts To Support Cop Convicted Of Murder Emails Entire Department Al Com

Huntsville Al Business License Fill Online Printable Fillable Blank Pdffiller